Overview

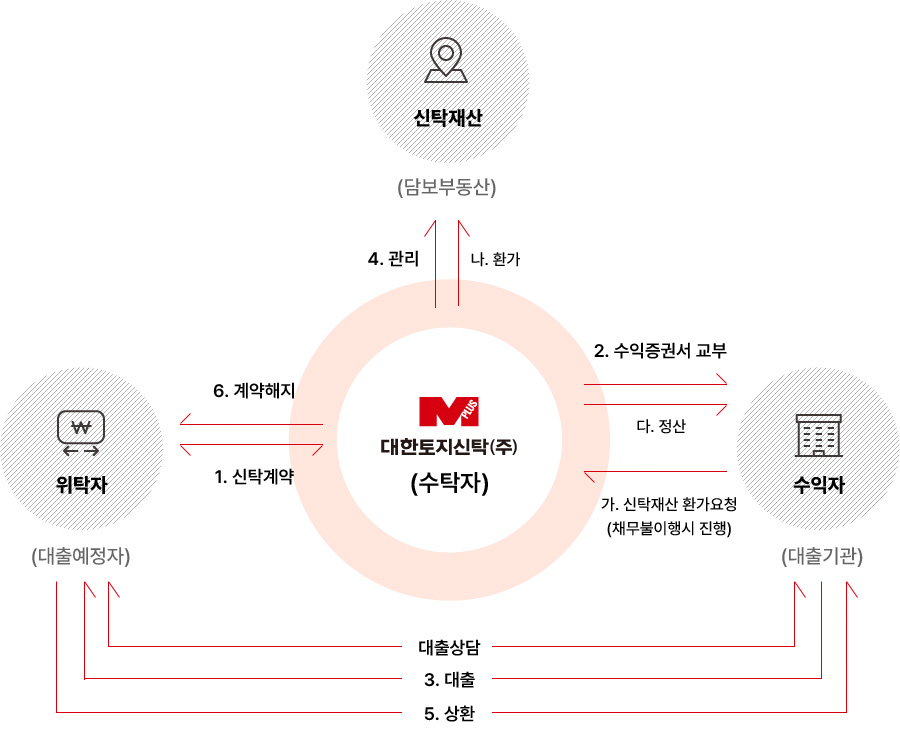

What is a Collateral Trust?

A collateral trust is an advanced financial product that replaces mortgages. It is a product where real estate is entrusted to a trust company, the financial institution is designated as the primary beneficiary, and a beneficiary certificate is issued.

Business Structure

Advantages

An advanced financial product replacing the mortgage system

Rapid disposal possible through auction in case of default

Minimizes losses by disposing at market-accessible prices

Workflow

Click on each step to view more details.

01

Consult and negotiate on loans

- Consult and negotiate loan conditions between lending institution and trustor (debtor)

- Request real estate investigation and analysis from trust company upon loan approval

02

Investigate and analyze collateral real estate (Inspect documents, conduct on-site investigations)

- Investigate rent, tax arrears, senior rights, etc. by the trust company

03

Compile an investigation and analysis report

- Identify real estate status and effective collateral value based on site inspection and rights analysis

- Confirm final trust contract conditions with financial institution

04

Approve loan conditions and request the issuance of a beneficiary certificate

- Record appraisal status, planned loan amount, trust institution, beneficiary certificate amount, etc.

05

Sign a trust contract (Register trust)

- Conclude trust contract between trustor and trust company

- Transfer ownership to trust company (trust registration)

06

Issue and deliver a beneficiary certificate

- Issue beneficiary certificate and copy of trust contract to lending institution

07

Execute a loan

- Send loan execution notice to trust company after loan processing

08

Manage trust property

- Inspect management status on-site upon request of primary beneficiary and notify changes to primary beneficiary

09

Repay the loan

- Return beneficiary certificate to trust company after loan repayment

10

Terminate the trust contract (End the trust)

- Transfer (revert) ownership to trustor by trust company

Realization Procedure (In case of default)

01

Request for realization

- Request realization to trust company when realization factors occur, such as loss of benefit of time

02

Public auction for disposal

- Dispose through open competitive bidding after final demand for debt fulfillment to debtor by trust company

- Can request suspension of realization if necessary

03

Settlement

- Distribute realization proceeds according to the order specified in the trust agreement

- Can request suspension of realization if necessary

Comparison between Collateral Trusts and Mortgages

| Sort | Collateral Trust | Mortgage |

|---|---|---|

| Collateral Setting Method | Transfer of ownership to trust company | Establishment of mortgage right |

| Collateral Real Estate Management | Managed by trust company | Managed by lending institution |

| New Lease, Subordinate Rights Establishment | Can be excluded | Cannot be excluded |

| Occurrence of Priority Claims after Collateral Acquisition | Cannot occur after trust registration | Wage claims can occur |

| Debt Collection Method | Direct auction by trust company | Auction |

| Debt Collection Period | Short-term | Long-term |

| Debt Collection Procedure | Simple | Complex |

| Debt Collection Cost | Low | High |

| Real Estate Disposal Value | Relatively high | Low |

| Exercise of Subrogation Right | No prior seizure necessary | Prior seizure necessary |

| Property Rights Protection | Prevention of third-party rights infringement after trust registration | Third-party seizure possible (Junior mortgage, seizure, provisional attachment of real estate, etc.) |

| Debtor's Cost | Low | High |

| Forced Execution by Junior Right Holders | Selectively possible (with consent of senior right holders) |

It is possible for third-party creditors to apply for compulsory auction or junior mortgage holders to apply for voluntary auction |

| Additional Collateral | Easy to add additional collateral trust (Simple lot addition) |

New establishment contract required |

Problems with the current mortgage system

- Requires excessive time and cost for court auction, which is the method of executing mortgage rights

- Property loss of real estate owners due to low-price successful bids

- Difficulty in managing collateral objects

- Hindrance to the liquidation of real estate value